Enter Password

UX DESIGNER

✦

10 WEEKS

COLLABORATED WITH PMs & DEVs

Overview

BECU (Boeing Employees Credit Union) is Washington’s largest credit union. Originally created for Boeing employees, it has since expanded to serve everyone. As a member-owned organization, BECU emphasizes community, trust, and accessible banking, values that extend to its digital experiences. The chatbot, however, hadn’t seen meaningful updates in years. Over time, the chatbot fell behind in both functionality and usability, creating friction in what should have been an easy support interaction.

As a UX Design Intern, I was responsible for leading the research for discovery and redesign of BECU’s chatbot experience identifying where it was falling short, understanding member expectations, and creating initial design directions for improvement. While I worked independently on this project, I was mentored by a senior UX researcher and a principal product designer, and reported directly to an Experience Design Manager. This autonomy allowed me to shape the direction of the project from research to concept design.

Problem

Members often left chats frustrated, leading to consistently low NPS and poor post-chat feedback.

Many members turned to call centers after failed chat interactions, increasing wait times and service load.

The chatbot’s old tech struggled to understand queries, eroding trust and making support feel unreliable.

Competitive Analysis

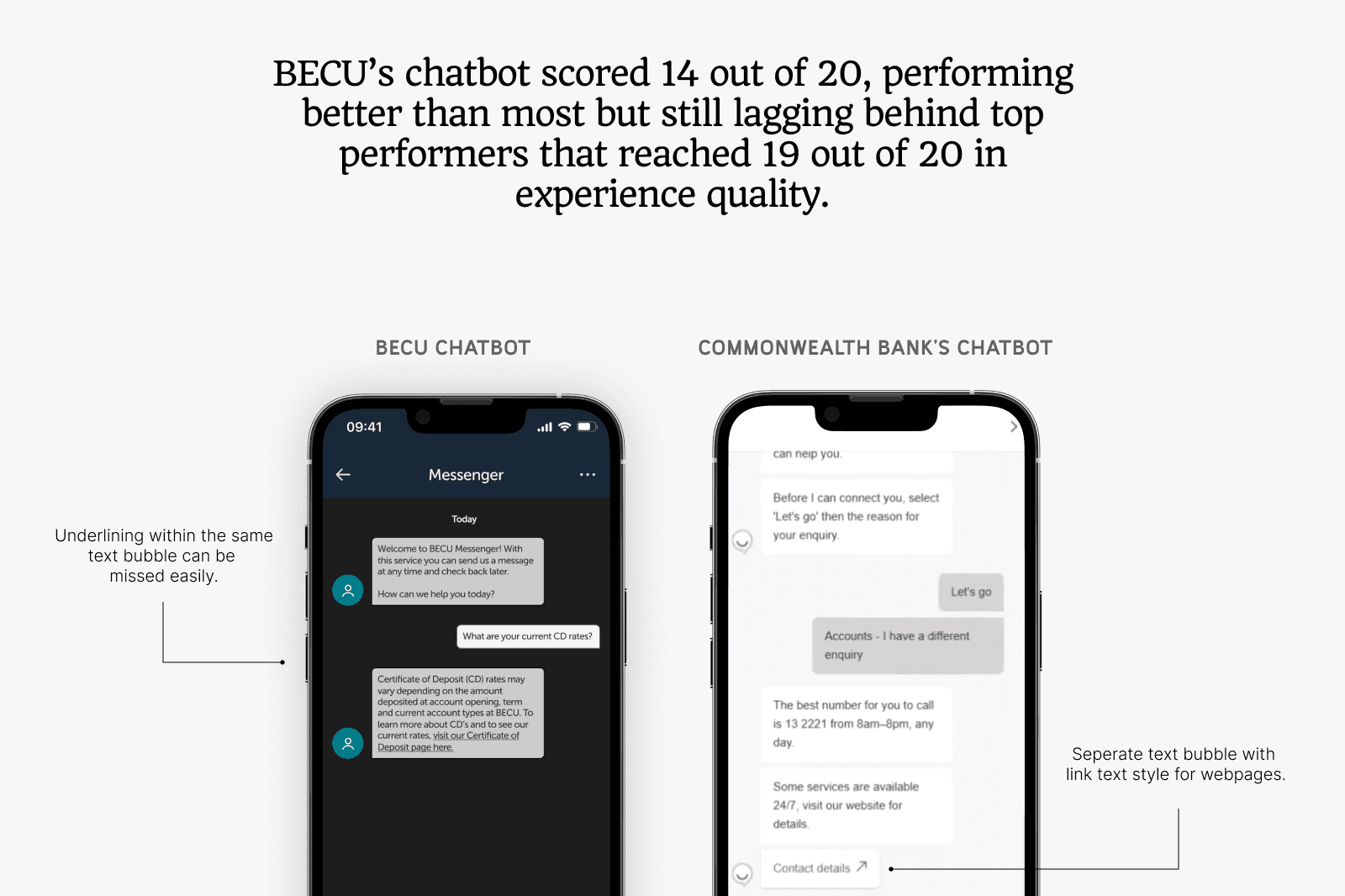

We evaluated 10 competitors (4 Credit Unions, 4 Banks, 2 Financial Services) against a set of usability heuristics. Each criterion was scored with a simple pass (+1) or fail (0), allowing us to benchmark their strengths and weaknesses and compare them consistently.

USABILITY HEURISTICS

Ease of Access

Flow & Interaction

Visual Design

Usability & Navigation

Tone of Communication

Advanced Capabilities

Some Things We Still Needed to Learn.

Which self-service channels do people rely on, and where does the chatbot fit in?

What are users’ expectations of AI-powered chatbots in financial contexts?

What triggers a switch to live support, and what would make that transition feel seamless?

User Research

To answer our research questions, we spoke with two groups: 4 existing BECU members who could provide insights based on experience, and 4 non-members who’re interested in self-service options. The sessions were conducted for 30 mins via UserTesting Dashboard over a week, with me as the moderator and my PM taking notes.

For analysis, 200+ quotes were organised and filtered into 12 findings and 3 themes.

INTERVIEW SCRIPT

Pain Points

→ Users often turned to the chatbot only after spending time searching or browsing. By then, they were frustrated and couldn’t easily find where to start a chat.

“Instead of doing a search, if I would go to the chatbot and say, hey, do you guys charge foreign ATM fees?” - Member (Age 45 -54)

→ Members wanted the handoff to a live agent to feel seamless, not like restarting the conversation. They also expected to see estimated wait times before escalation.

“I understand the limitations of a chatbot. It cannot do certain things and then you have to reach out to a person. But it can at least make that process [reaching out to an agent] easier. “ - Member (Age 25 -34)

→ Users expected the chatbot to act like a smart assistant, providing contextual answers, direct links, and next steps, rather than functioning as a rigid help menu.

“If you're gonna create a bot helper that's gonna answer questions, you need to be able to get the answers you need quickly, or people are not gonna have trust in that chatbot." - Non-Member (Age 25 -34)

ITERATIONS & DESIGNS

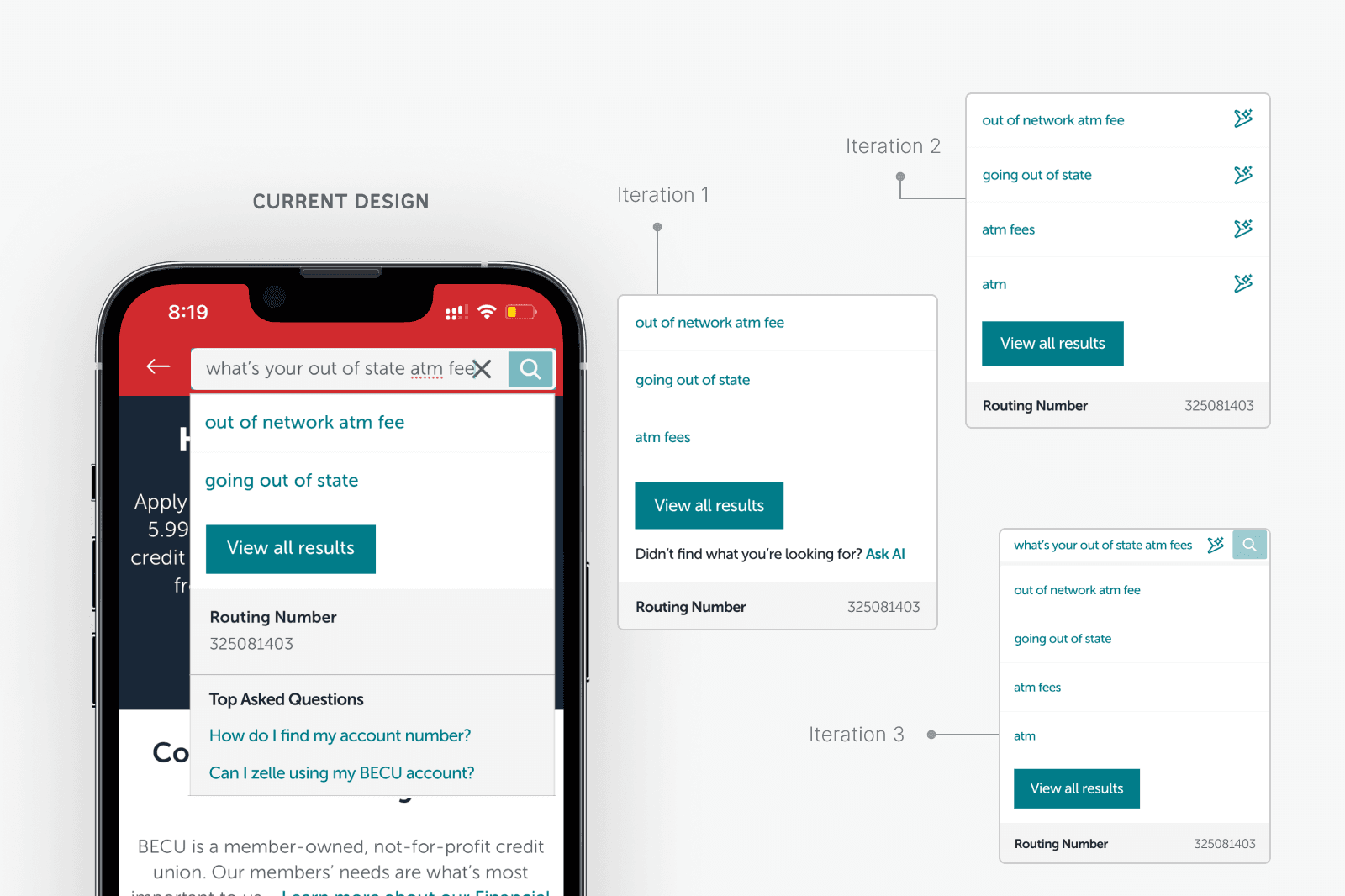

Integrating Chatbot into Search as an Entry Point.

Most users naturally turn to search when they’re looking for information or support, which makes it a powerful and intuitive entry point for the chatbot. By embedding the chatbot into the search bar or results page, we surface assistance early in the journey without relying on disruptive popups.

FINAL DESIGN

ITERATIONS & DESIGNS

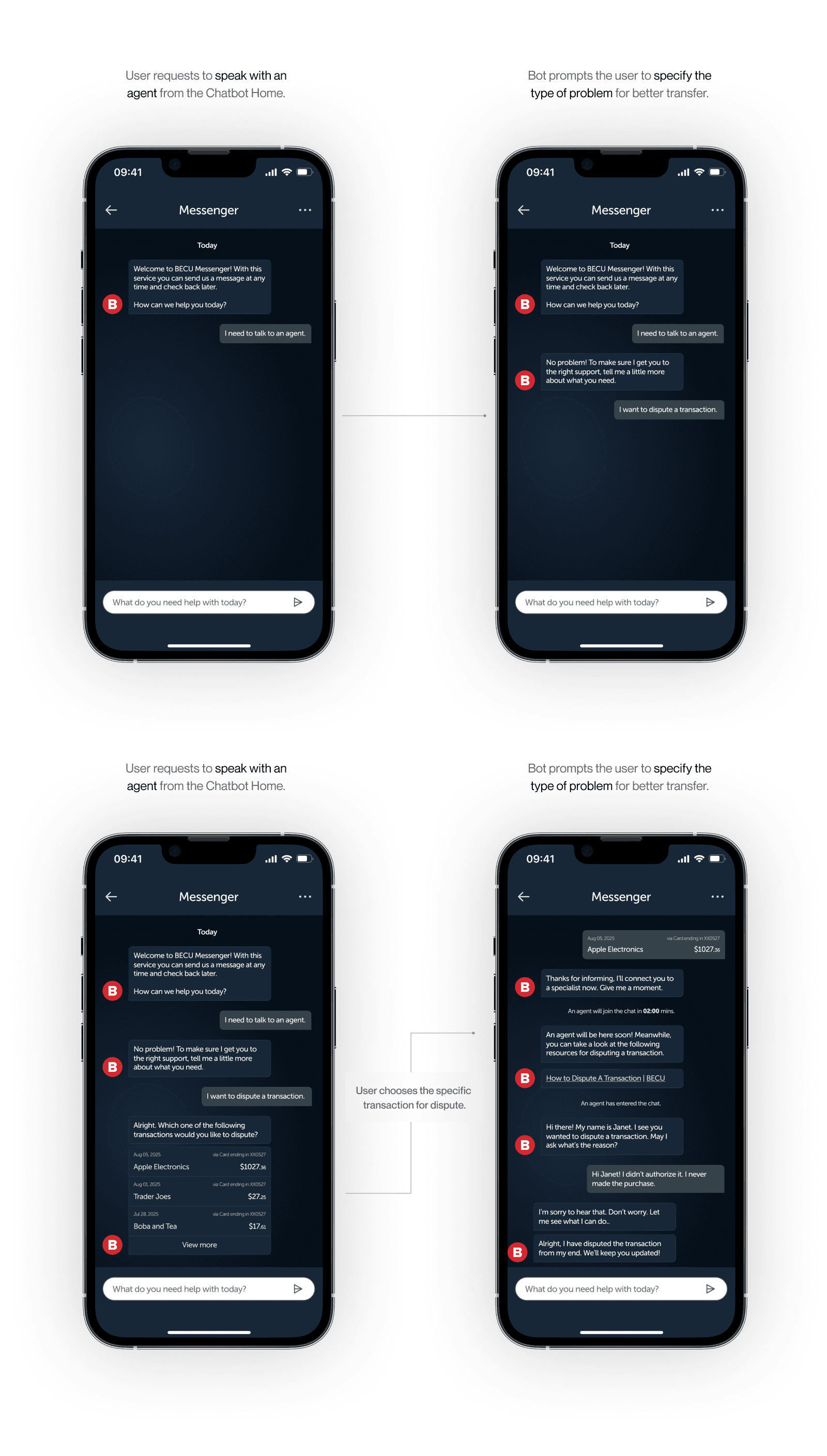

Setting Expectations and Sharing Context Before Live Agent Joins.

When users escalate to a live representative, the transition is often marked by uncertainty and repeated questions. By displaying estimated wait times, we set clear expectations and reduce frustration during the handoff. Collecting a few preliminary details upfront and summarizing the chatbot conversation ensures that agents join with full context, minimizing repetitive back-and-forth and speeding up resolution.

FINAL DESIGN

ITERATIONS & DESIGNS

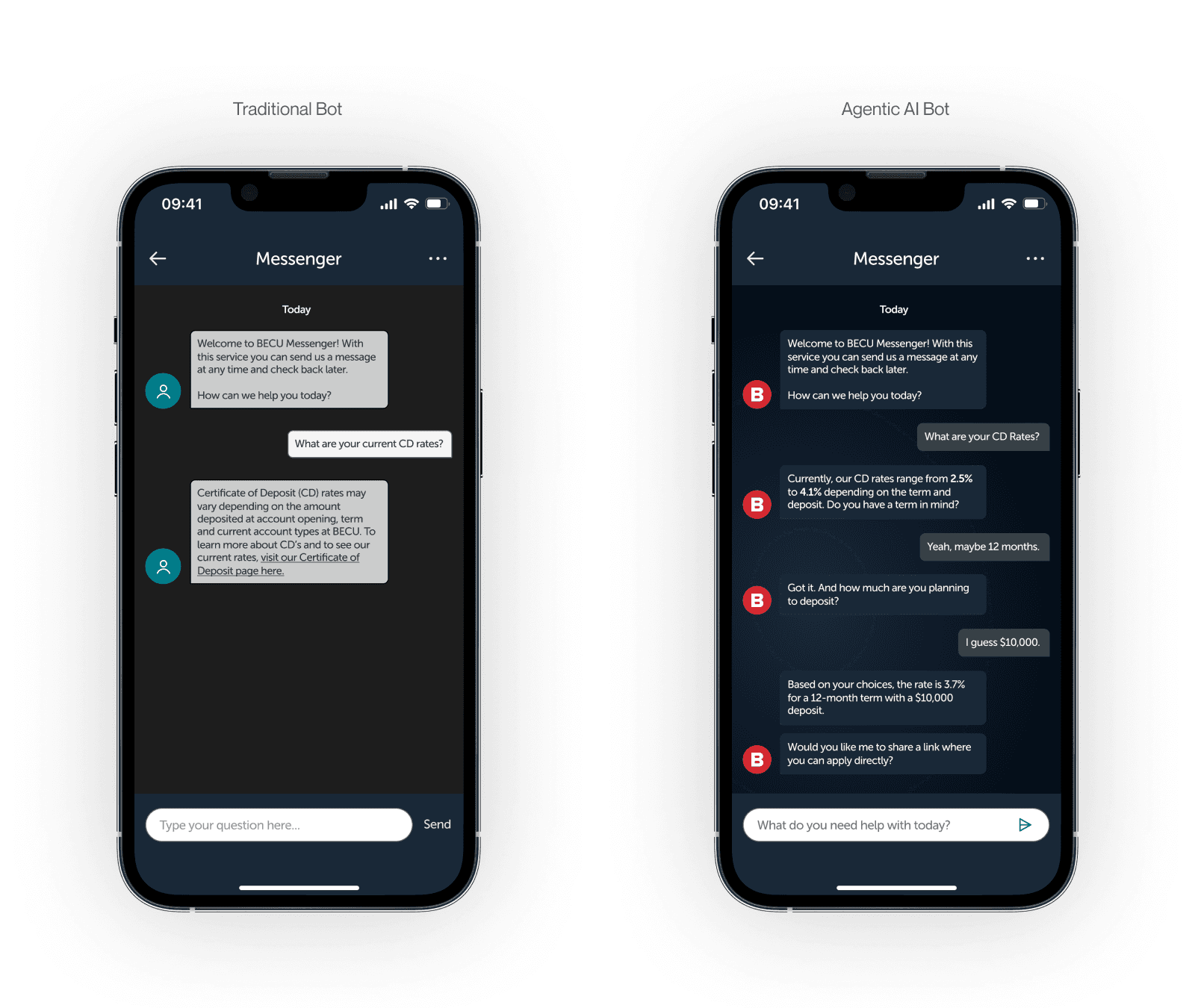

Transforming Traditional Bots into Proactive Assistants.

Traditional decision-tree chatbots often erode trust, as users feel they could get faster and more specific answers from generic AI tools like ChatGPT which can lead to drop offs. To address this, we explored emerging technologies and realized that while generative AI can help, it’s agentic AI that truly adds value. Agentic AI not only understands the context but provides proactive, intelligent responses, making interactions feel more human and trustworthy.

How Agentic AI works?

Intent Management

When working with Conversational AI, intent management is a key focus. To understand the use cases we were addressing, I explored the Intent Management dashboard alongside my PM. This helped me identify the top questions and intents users were submitting.

Account Management, Limits, Disputes, and Information on Rates emerged as the most common chatbot intents.

Agentic Workflows

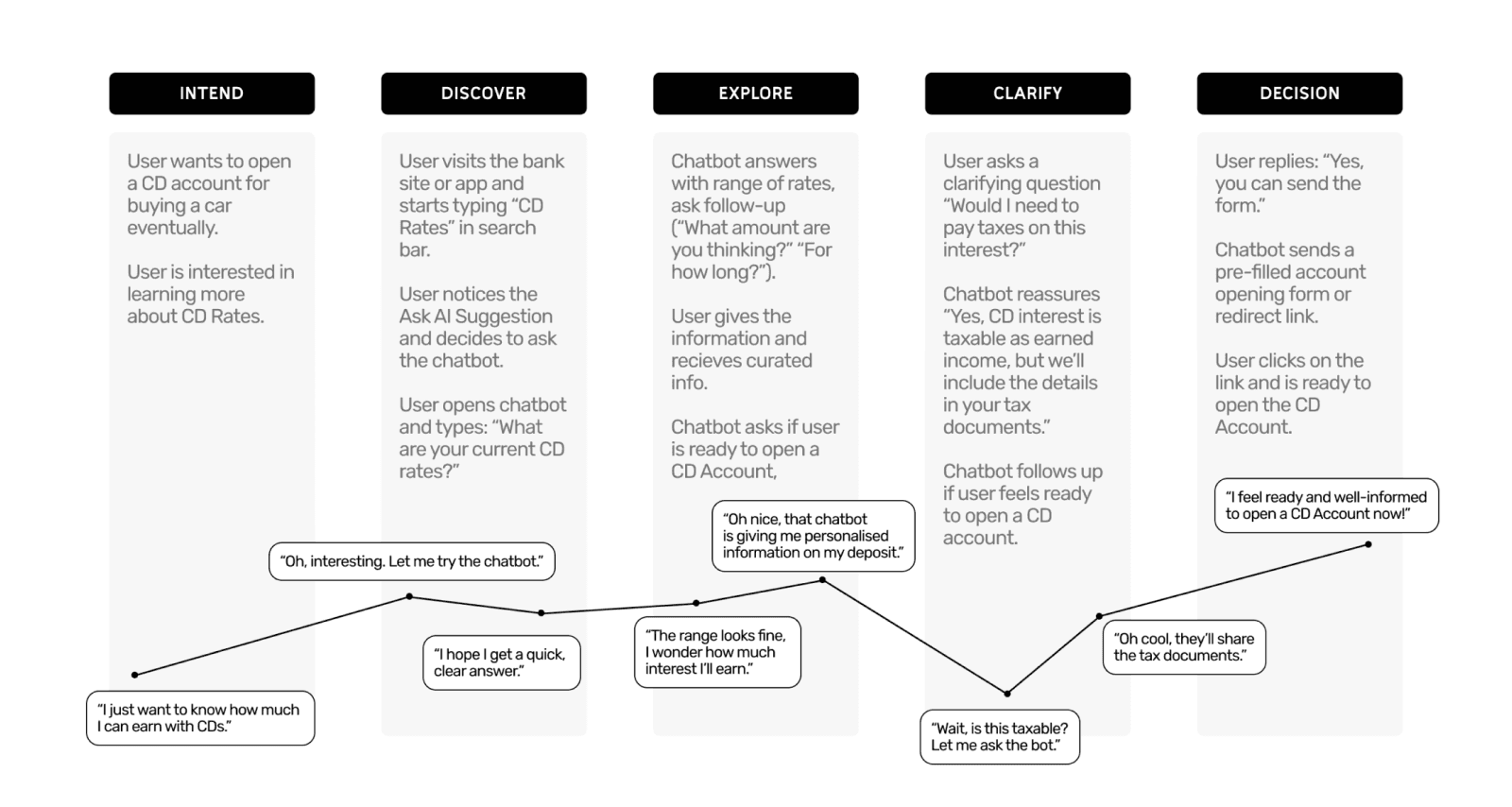

A key aspect of Agentic AI is working closely with engineers to design the workflows that agents follow to deliver curated, intelligent responses. For the 15 most common use cases based on top user intents, I developed the corresponding user journeys and agentic workflows.

SCENARIO

User wants to learn more about the CD Rates and potentially open an account with BECU.

User Journey

Agentic Workflow

Designs

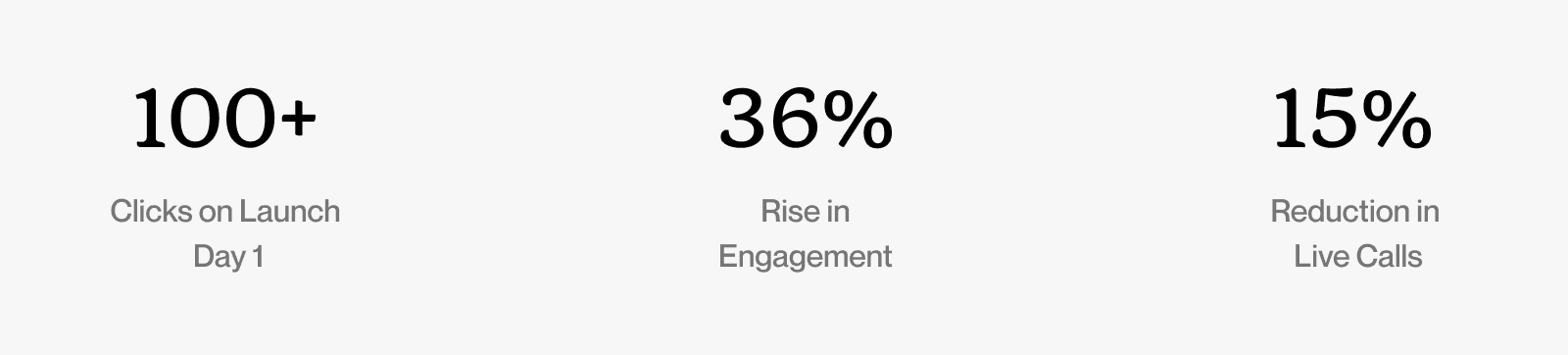

Impact! + Reflections

The remaining design improvements are still being implemented because they require integrating with existing workflows and building smarter AI capabilities. The entry point strategy was faster to implement, so we launched it first.